The state of Ohio continues to produce high-quality high-school softball players who will put their talents on display this spring.

As a preview to this season, the high school sports staff of the USA Today Network’s 21 Ohio newspapers and websites compiled a who’s who of the Buckeye State’s prep softball players.

This is part of a series that included boys and girls basketball’s top 24 players this winter and, in fall, included football , volleyball , boys soccer and girls soccer .

How they were ranked

USA TODAY Network Ohio staff across the state researched and compiled a list of its respective area’s top players. The journalists voted on these players using a point system. Those points were tabulated to determine the top 24 players.

1. Haley Ferguson, Beavercreek

The senior pitcher was first-team all-state in Division I last year with a 0.95 ERA and 224 strikeouts in 147 ⅓ innings. Ferguson batted .539 with 41 hits, 24 RBI and four home runs in 76 at-bats. She has signed with Michigan.

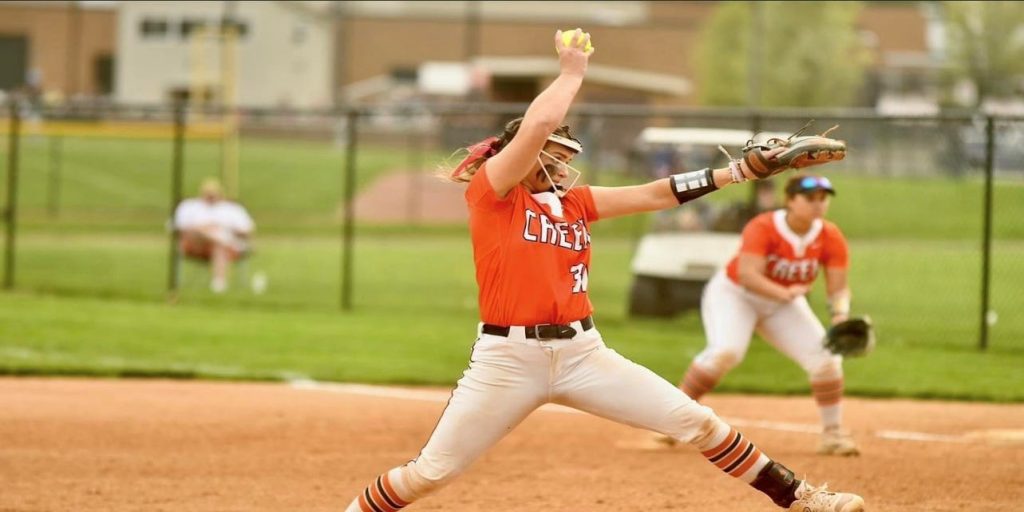

2. Carsyn Cassady, Watkins Memorial

The senior pitcher was first-team all-state in Division I after a 20-win season in the circle, despite missing some time with an injury. Cassady had a 0.62 ERA and three no-hitters in 112 innings. Cassady, who plays club ball for Thunder Elite, has signed with Michigan State.

3. Kat Meyers, Whitehouse Anthony Wayne

The senior pitcher earned first-team all-state in Division I last season after leading Anthony Wayne to the state championship game. Meyers had a 1.20 ERA with 113 strikeouts in 56 innings. She has signed with Michigan.

4. Sydnie Watts, Austintown-Fitch

The junior pitcher was the only underclassman to earn first-team all-state in Division I a season ago. Watts had seven no-hitters and a 0.38 ERA in finishing 21-0 for the reigning state champions. As a batter, Watts had a .492 average in 61 at-bats with 30 hits, 23 RBI and six home runs. She has committed to Georgia Tech.

5. Gabby Gradishar, Warren Champion

The junior pitcher was first-team all-state in Division III last year with a 17-5 record and 0.94 ERA in 134 ⅔ innings with 249 strikeouts and 12 shutouts. At the plate, Gradishar batted .629 with 61 hits, 46 RBIs and 18 home runs in 97 at-bats. She is committed to Penn State.